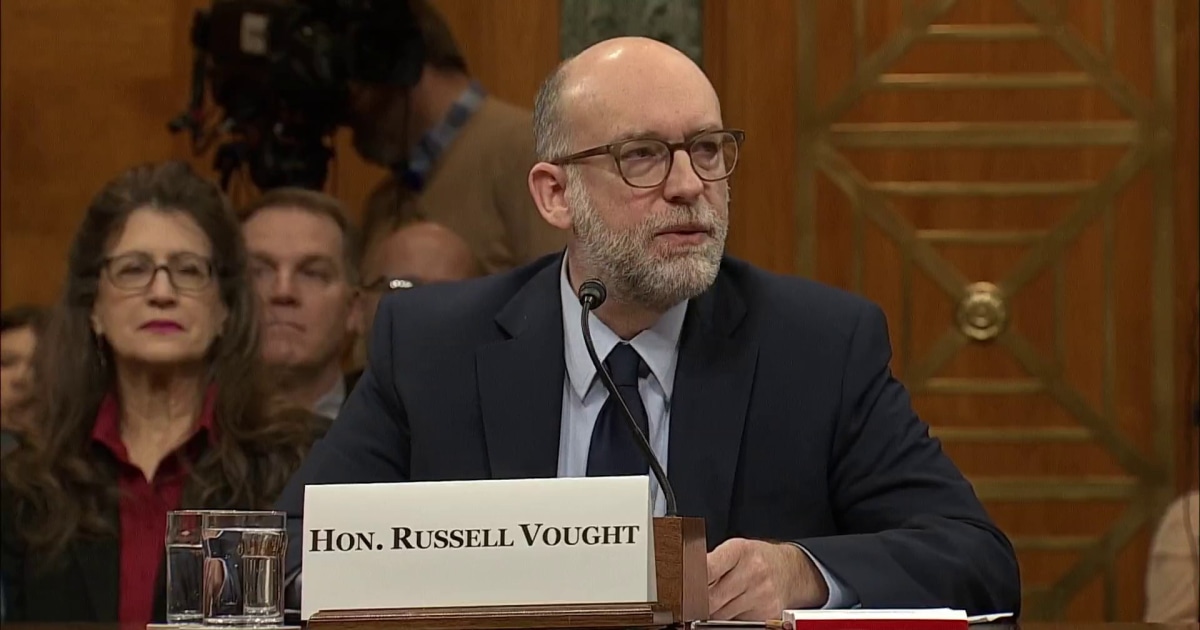

Navigating Fiscal Responsibility: Russell Vought’s Call for Wise Taxpayer Spending

In a recent Senate hearing, Russell Vought, former Director of the Office of Management and Budget (OMB), made a compelling case for the prudent allocation of taxpayer dollars. His remarks ignited a vital discussion on fiscal responsibility and government accountability, emphasizing the importance of both transparency and efficiency in public spending. Vought’s insights reflect a broader sentiment among many Americans who are increasingly concerned about how their hard-earned tax money is utilized.

The Importance of Fiscal Responsibility

Fiscal responsibility refers to the government’s obligation to manage public funds wisely. This includes ensuring that taxpayer dollars are spent effectively, minimizing waste, and maximizing the benefits of government programs. Vought’s emphasis on this topic comes at a time when national debt and budget deficits continue to rise, prompting citizens and lawmakers to scrutinize federal spending more closely.

Vought’s call for wise taxpayer spending resonates with many who believe that government should be held accountable for how it allocates resources. The necessity of fiscal responsibility can be broken down into several key areas:

- Transparency: Citizens have the right to know how their taxes are being spent. Transparency builds trust and encourages informed public discourse.

- Efficiency: Government programs should aim for maximum impact with minimum expenditure. This requires regular assessments and adjustments based on performance metrics.

- Accountability: Government officials must be held accountable for their spending decisions, ensuring that they align with the needs and desires of their constituents.

Vought’s Perspective on Taxpayer Spending

During the Senate hearing, Vought articulated specific strategies for improving taxpayer spending. He stressed the importance of prioritizing essential services and cutting back on unnecessary expenditures. Vought pointed out that many government programs overlap, resulting in inefficiencies that ultimately cost taxpayers more than necessary. By streamlining services and eliminating redundancies, the government can save significant amounts of money.

Moreover, Vought highlighted the importance of data-driven decision-making. He argued that funding should be allocated based on empirical evidence of program effectiveness rather than political considerations or lobbying pressures. This approach not only enhances accountability but also ensures that taxpayer dollars are directed toward initiatives that yield real results.

Broader Implications of Fiscal Responsibility

The discussion around fiscal responsibility isn’t just about numbers; it has real implications for society. Wise taxpayer spending can lead to improved public services, infrastructure development, and educational opportunities. When governments operate efficiently, they can invest in the future, fostering economic growth and stability.

Conversely, lack of fiscal responsibility can lead to significant consequences, including:

- Increased National Debt: Overspending can contribute to a rising national debt, which future generations will have to grapple with.

- Reduced Public Trust: When citizens perceive waste or mismanagement, trust in government institutions erodes, leading to apathy and disengagement.

- Economic Instability: Poor financial management can result in economic downturns, impacting job creation and overall prosperity.

The Role of Citizens in Fiscal Responsibility

While government accountability is essential, citizens also play a crucial role in promoting fiscal responsibility. Engaged citizens can advocate for transparency, demand better budgeting practices, and hold elected officials accountable. Here are some ways individuals can contribute:

- Stay Informed: Understanding how government budgets are created and allocated can empower citizens to make informed decisions and voice their opinions.

- Participate in Local Governance: Attending town hall meetings or participating in community forums allows citizens to engage directly with policymakers.

- Advocate for Reforms: Support initiatives aimed at increasing transparency and accountability in government spending.

Conclusion: A Collective Responsibility

In conclusion, Russell Vought’s call for wise taxpayer spending serves as a reminder of the importance of fiscal responsibility in government. As national debt continues to rise and public trust in government wanes, the need for prudent allocation of taxpayer dollars has never been more urgent. By prioritizing transparency, efficiency, and accountability, governments can create a framework that not only respects taxpayer contributions but also fosters a thriving society.

Ultimately, fiscal responsibility is a collective endeavor that requires the commitment of both government officials and citizens alike. Together, they can navigate the complexities of budgeting and spending, ensuring that taxpayer dollars are used wisely for the benefit of all. As the debate continues, it is crucial to remember that every dollar spent is a reflection of the priorities and values of the society it serves.

See more BBC Express News